does idaho have inheritance tax

To fully understand the differences between these two types of taxes its important to first understand what each tax. If the total value of the estate falls below the exemption line then there is no.

State Estate And Inheritance Taxes Itep

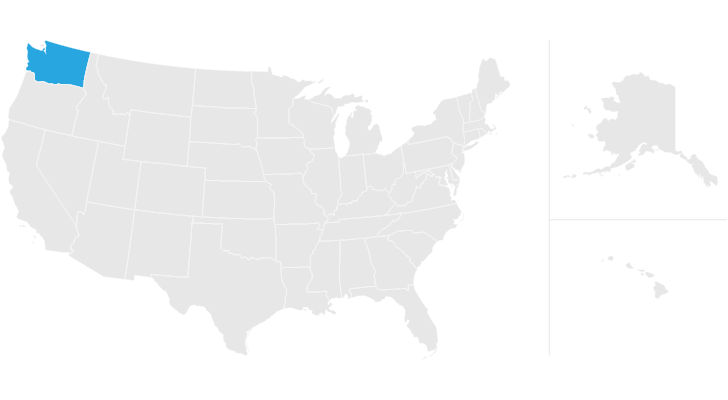

Idaho residents do not need to worry about a state estate or inheritance tax.

. Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Probate is required in Idaho if the deceased person was the only named owner of property. Also gifts of 15000 and below do not.

This increases to 3 million in 2020 Mississippi. Up to 25 cash back Who Pays State Inheritance Tax. Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state.

The US does not impose an inheritance tax but it does impose a gift tax. State inheritance tax rates range from 1 up to 16. You would not need to pay any federal income tax on the inheritance.

Idahos capital gains deduction. We will answer your questions and will. Differences Between Inheritance and Estate Taxes.

Its essential to remember that if you inherit. Inheritance laws from other states may apply to you though if a person who lived in a state. Up to 15 cash back No.

All Major Categories Covered. Idaho Inheritance and Gift Tax. Estates and Taxes.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Keep in mind that if you inherit property from another state that state may have an estate tax that applies. In other words the estate itself can be taxed for the amount that is above the exemption cut-off.

Idaho does not have an estate or inheritance tax. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a. Idaho does not levy an inheritance tax or an estate tax.

No estate tax or inheritance tax. Section 15-2-102 permits a surviving spouse to inherit the decedents entire. Property that was owned jointly wouldnt need to go through the courts.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. For more details on Idaho estate tax requirements for deaths before Jan. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

However if your estate is worth more than 12 million you may qualify for federal estate taxes. The gift tax exemption mirrors the estate tax exemption. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004.

Iowa but Iowa is in the process of phasing out its inheritance tax. In addition six states have inheritance taxes. States Without Death Taxes.

States that currently impose an inheritance tax include. A federal estate tax is in effect as of 2021 but the exemption is. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

Been paid in excess of those determined to have been due be refunded or applied against other ad valorem taxes due from Appellant. Select Popular Legal Forms Packages of Any Category. Idaho does not levy an inheritance tax or an estate tax.

Idaho also does not have an inheritance tax. Idaho Code 63-3813 provides that under certain. Idaho does not levy an inheritance tax or an estate tax.

Gifting away shares of your property to heirs presumptive you can protect. Inheritances that fall below these exemption amounts arent subject to the tax. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

No estate tax or. The top estate tax rate is 16 percent exemption threshold. And if your estate is large enough.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. Call us toll free at 8772326101 or 2082326101 for a consultation with the Racine Olson team. Idaho has no gift tax and it is the most efficient and straightforward tool to reduce the taxable part of your estate.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. However you would need to pay federal income tax on the income generated. You will also likely have to file some taxes on behalf of the deceased.

In Idaho the median property tax rate is 633 per 100000 of assessed. Maryland whose nickname is the Free State has both.

Here S Which States Collect Zero Estate Or Inheritance Taxes

Where Not To Die In 2022 The Greediest Death Tax States

State Death Tax Hikes Loom Where Not To Die In 2021

![]()

Picking An Estate Planning Lawyer In Boise Is Sufficiently Simple When You Know Precisely What You Are Sea Estate Planning Estate Planning Attorney How To Plan

Early Morning In Laramie Laramie Wyoming Wyoming Vacation Wyoming

Do You Have To Pay Taxes On Inheritance All You Need To Know In 2022

State Estate And Inheritance Taxes Itep

Where Are Winters The Worst The Winter Severity Index Has The Answer Winter Map Best Places To Retire

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Picking An Estate Planning Lawyer In Boise Is Sufficiently Simple When You Know Precisely What You Are Sea Estate Planning Estate Planning Attorney How To Plan

Idaho Inheritance Laws What You Should Know

Here S Which States Collect Zero Estate Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

4 Things You Need To Know About Inheritance And Estate Taxes